Why Tamworth Should Be on Every Property Investor’s Radar in 2026

If you’re an investor chasing capital growth, strong rental yields, low vacancies, and future demand fundamentals, then Tamworth — a thriving regional center in northern New South Wales — is well worth your attention. With major infrastructure investment, robust population growth and tightening supply, this city offers a compelling combination of affordability and long-term potential that many investors are overlooking.

A Strategic Location With Regional Economic Strength

Located approximately 415 km north of Sydney and 270 km inland from Port Macquarie, Tamworth sits at a logistical crossroads of road, rail, and air transport — making it a critical service and freight hub for the New England region. This strategic position underpins its role as a major agribusiness, freight and renewable energy center for northern NSW, supporting a diversified economy supported by various industries.

The local economy generates more than $4.1 billion annually, backed by healthcare, agriculture, manufacturing, education and tourism — all key drivers of employment and population stability. Agriculture alone contributes more than $600 million, while manufacturing claims the highest export value in the region. Healthcare is the largest employer, anchored by regional specialist services and the Tamworth Hospital.

Tamworth Population & Lifestyle : Growth Backed by Strong Fundamentals

Tamworth is known nationally for its Country Music Festival, its thriving equine sector and its mix of cultural, educational and sporting facilities — attractive to investors and families and professionals seeking regional lifestyle value.

The city’s population has grown from nearly 60,000 in 2016 to around 64,000 today, and is forecast to exceed 80,000 by 2041 a projected rise of more than 21% over the next 15 years. This expansion fuels long-term housing demand and supports sustained rental and price growth. Home ownership remains strong too, with around 61% of households owning or purchasing their homes, which underpins market stability.

Tamworth Property Prices : Growth Meets Affordability

Even with recent growth, Tamworth remains comparatively affordable by NSW standards — a significant drawcard for investors priced out of capital cities.

- Median house prices sit around $595,000 (Q3 2025) — with annual growth of ~14% year on year for houses and ~4% for units.

Earlier data also show strong house price growth trends, with properties appreciating significantly over recent years.

Affordability spreads across a range of suburbs:

- South Tamworth, West Tamworth and Paraba have median house prices below $500,000, ideal entry-level investment pockets.

- Premium lifestyle suburbs such as Morecreek approach closer to $900,000 for larger land lots and amenity appeal.

Tamworth Rents & Yields : A Tight Rental Market

Investors will be particularly excited by Tamworth’s rental dynamics:

- Rental vacancy rates across the LGA are extremely low — around 1.0–1.4%, substantially beneath the Real Estate Institute of Australia’s benchmark of 3.0%.

Median weekly rents for houses have climbed steadily, reflecting strong demand and healthy rental returns for investors.

Gross rental yields range from ~4% in higher-priced suburbs to 6%+ in more affordable pockets, with units also performing strongly in yield terms.

Tight vacancy rates are not just a snapshot — rentals are absorbing quickly, and many areas currently have no listings available at all. This dynamic creates strong cash flow opportunities for investors while capital values continue to climb.

Tamworth Infrastructure & Future Drivers of Demand

Perhaps Tamworth’s most compelling long-term fundamentals are the major projects and infrastructure investments underway:

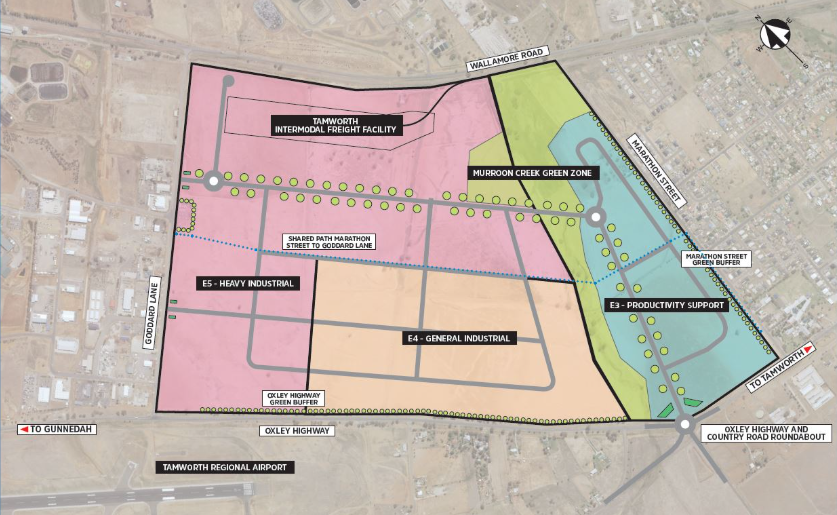

🔹 Tamworth Global Gateway Park — a multi million-dollar logistics hub designed to boost freight and supply chain capability, driving jobs and local economic growth.

🔹 Inland Rail connectivity — further anchoring Tamworth’s role in inter-regional transport networks.

🔹 Large-scale renewable energy developments — positioning the region as a renewable energy hub.

🔹 New CBD university campus — a University of New England installation planned to attract students and staff.

🔹 Continued upgrades to airport facilities, healthcare and education infrastructure.

Such investments not only drive employment and population growth, they also support sustainable demand for housing and rental accommodation over the long term.

Supply Constraints: A Tailwind for Growth in Tamworth

Despite strong demand, housing supply in Tamworth has not kept pace. New residential builds and lot releases are limited compared to the volume of sales — a structural undersupply that supports upward price pressure and further tightens rental markets.

In simple terms: more buyers and renters are chasing fewer homes — a scenario investors dream about.

What This Means for Property Investors

Tamworth ticks the boxes most property investors are chasing right now:

✅ Affordable entry point compared to metropolitan markets

✅ Strong rental yields well above many capital city options

✅ Low vacancy rates indicating high demand

✅ Projected population growth, especially among families and professionals

✅ Major infrastructure and economic drivers to support long-term growth

✅ Diversified local economy, reducing dependence on one sector

From a strategic perspective, Tamworth may be maturing — but its long-term fundamentals are as solid as ever. Whether you’re looking for steady cash-flow, capital growth, or a mix of both, this regional centre deserves serious consideration within a diversified investment portfolio.

Why Queensland makes Investment Sense

Why investing where Infrastructure is and is coming makes investment sense

High Yield Investment Property and why I wouldn’t invest in Co-Living Property