Thinking of Investing – give consideration to Perth in WA?

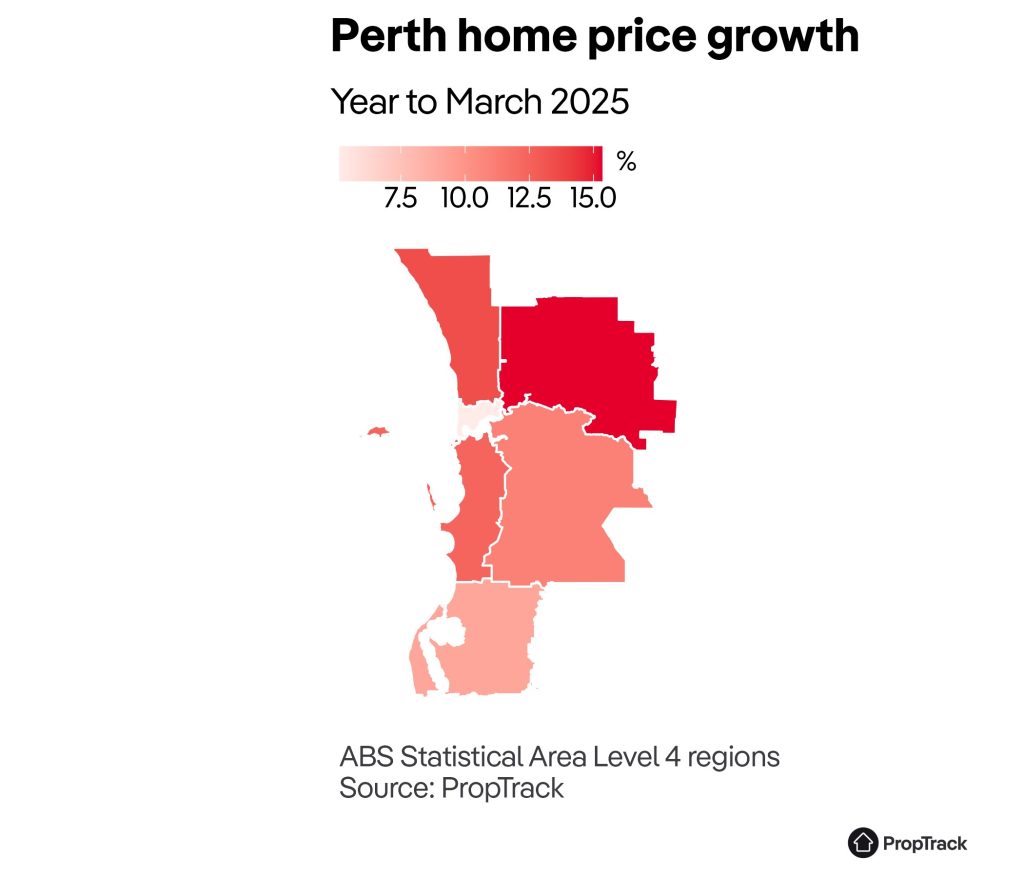

According to CoreLogic, Perth dwelling values surged 14.3 per cent over the past year, delivering a nation-leading 75.9 per cent growth over the past five years.

“Waiting could cost You thousand’$”

Why Perth Property Is Booming — and Why Waiting Could Cost You Thousands

Western Australia’s housing market continues to surge, and those waiting on the sidelines risk paying more for the same opportunity.

Perth’s property market is rewriting the playbook for Australian real estate. After twelve consecutive quarters of growth, the city’s median house price now sits at $981,259 — and is expected to smash through the $1 million mark before Christmas, according to The West Australian. That’s an extraordinary milestone for a city once considered one of the most affordable capitals in the country.

So what’s driving the surge — and why does it matter for investors? Let’s break it down.

1. The Perfect Storm of Growth Drivers

WA’s property fundamentals are the envy of the nation. According to leading analysts Damian Collins (Momentum Wealth), Gavin Hegney (independent property expert), and REIWA President Suzanne Brown, Perth is positioned for another 8 – 10% rise in 2026.

That follows multiple years of sustained double-digit growth — and it’s not slowing.

Key drivers include:

- Rapid population growth and strong net migration.

- A robust local economy with high wages and the lowest unemployment rate of any state.

- Ongoing housing undersupply — a structural deficit of around 15,000 homes.

- Labour shortages in construction slowing the delivery of new housing stock.

As Collins notes, “The supply-demand imbalance is firmly entrenched, positioning Perth for another sustained run of capital growth.”

In short: these aren’t short-term conditions — they’re structural. It could take years before the market reaches equilibrium. A ‘perfect storm’ for Investors looking for capital growth potential + sound rental yields from their investment.

2. Perth’s $1 Million Milestone — and Why It Matters

According to The West Australian and Domain’s latest research, Perth house prices have risen for the 12th consecutive quarter, increasing 1.6% in the September quarter alone — an extra $15,382 in value.

The city’s unit market is performing even more impressively, jumping 4% last quarter to a median of $560,471 — and delivering the strongest annual unit gains of all Australian capitals, up 16.4% year-on-year.

Dr Nicola Powell, Domain’s Chief of Research and Economics, attributes this surge to “three RBA rate cuts, rising consumer confidence, low levels of supply, and a rise in population.” She predicts the Federal Government’s 5% Home Guarantee Scheme will further accelerate demand, keeping upward pressure on both houses and units.

The takeaway for investors? Perth is not cooling off — it’s gearing up. The market is not only robust but expanding in both value and depth.

3. Suburb Standouts: Growth That Speaks for Itself

While prestige areas like Cottesloe (-13.2%) and Nedlands (-9.2%) have seen small corrections after major highs, many mid-tier suburbs are on fire:

- Ardross (south of the river) is up 39% over the past year, now sitting at a $1.85 million median.

- White Gum Valley has risen 32.8%, reaching $1.295 million.More Suburbs to Watch

- Bateman (mid-to-upper ring): Reported annual house price growth of approximately 37.9 %. Australian Property Investor Magazine+1

- Madeley (northern suburbs): Displaying ~30.3 % annual price growth. Australian Property Investor Magazine+1

- Woodvale: Median around $1.12 million and price growth ~25.4 %. Australian Property Investor Magazine

- Ellenbrook (outer-northeast): Identified as a value play for future growth, good rent yields and infrastructure.

These figures prove that momentum isn’t isolated — it’s widespread across both established and emerging suburbs.

Investors entering now have the chance to capture this next wave before Perth’s affordability advantage disappears entirely.

At properT network, we offer you access to our 19 years experience in the investment property sector, as well as our skills and strengths in guaranteeing to save you time, match you to a selection of ‘best fit’ properties to suit your investment strategy, the outcome you are wanting to achieve and within the budget you have available to you – so that you can make more money from your informed and educated property investment.

4. The Urgency: Why Waiting Will Cost You

Too many investors are “waiting for prices to soften.” But experts warn that could be a long and expensive wait.

Every quarter of delay means higher entry prices and stronger buyer competition.

A 10% annual rise on today’s $981,000 median means you could pay nearly $85,000 more for the same property next year.

Meanwhile, Perth’s rental vacancy rate sits near 1%, among the tightest in the nation — meaning strong yields, reliable tenants, and excellent cash flow for investors.

Those combining Perth’s growth potential with WA’s high-yield environment are in one of the best positions for both rental performance and long-term capital appreciation.

5. The Investor Opportunity

For investors seeking value, Perth offers a rare combination:

✅ Affordability compared to Sydney, Melbourne, and Brisbane.

✅ High rental yields due to record-low vacancy rates.

✅ Sustained population growth and job creation.

✅ Ongoing housing shortage and limited new supply.

The market’s fundamentals are rock-solid, but affordability won’t last forever. As prices edge closer to — and soon beyond — the $1 million median, the entry window is narrowing.

Not all property is Investment Grade and Worthy of your Investment Dollars!

how do you know which are … we do.

Final Word: Don’t Miss the Momentum

Western Australia’s property market is not a passing trend — it’s a structural story of growth, demand, and economic resilience.

Those who act now position themselves to benefit from Perth’s next growth cycle. Those who hesitate risk paying significantly more for the same asset. Forfeit both rent and will pay the tax man more than they you should.

If you’ve been waiting for the “right time” to invest, this is it. Perth is in the middle of its strongest and most sustainable growth phase in decades. The longer you wait, the more you’ll pay.