If you’re an astute property investor looking for strong growth, healthy rental yields and affordability — then the regional city of Toowoomba in Queensland deserves your attention. With a median house price under A$720,000, rental yields north of 4 %, vacancy rates around 0.5% and a major infrastructure pipeline including the national Inland Rail, Toowoomba is quietly transforming from a lifestyle regional city into a logistics and services hub. In this blog we explore why investing in Toowoomba makes sense — and what to watch when selecting your investment property.

Affordability + Growth Potential

Toowoomba offers a compelling mix of affordability and upside for investors being a rising regional property market with sound population growth and strong demand for housing to own or rent.

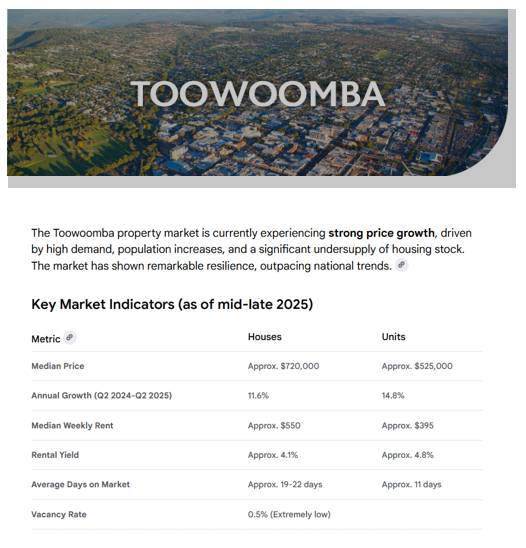

- The median house price in Toowoomba is around under $720k (for key postcodes) which is up around 14.7% year-on-year

- Units in the region are showing strong movement too, with quoted median around $417,500 and annual growth around 14.4%

- Rental yields are attractive compared with many capital city markets. For houses, about 4.1% as of June 2025. PRD Real Estate+1 Units may even offer higher yields. Herron Todd White+1

- Vacancy rates are extremely low e.g., ~0.5% in June 2025 in the LGA. PRD Real Estate+1

So for investors: you’re investing into a market with solid rental returns, strong growth potential, and comparatively lower entry price than many metro locations.

Infrastructure & Economic Drivers

One of the major reasons Toowoomba is flagged as a “growth city” is its infrastructure pipeline and economic diversification.

- The national Inland Rail project runs through and around Toowoomba (sections like Gowrie-to-Helidon) and is set to boost freight connectivity and logistics capacity. Inland Rail+2yoursay.tr.qld.gov.au+2

- The region is also developing the InterLinkSQ logistics hub (13 km west of Toowoomba CBD) which will link road, rail, air and sea freight, making Toowoomba a logistics/industrial node. interlinksq.com.au+2bradlippthelandman.com.au+2

- Urban renewal projects such as the Toowoomba Railway Parklands Priority Development Area (PDA) in the city centre (~50-70 ha) are being planned to boost mixed-use and residential development. Queensland Government+1

- According to one economic profile, Toowoomba is projected to grow its population and is among the faster-growing LGAs in Queensland. Colliers

These structural drivers matter because they underpin long-term demand for property (both owner-occupiers and tenants), improve employment and amenities, and support capital growth rather than being purely speculative.

Population & Demand Tailwinds

- Forecasts suggest the region’s population will increase significantly (for example: projected to ~211,000 by 2041) and growing suburbs like Toowoomba-West, Highfields, etc are identified as expansion areas. Colliers

- With supply relatively constrained (housing lots, new builds) and strong demand (from people relocating, lifestyle seekers, investors), the conditions favour upward pressure on both rents and valuations.

Rental Market Strength

For property investors, rental market fundamentals are key and Toowoomba stacks up well :

- Median weekly rent for houses recently was around A$550/week. PRD Real Estate+1

- House rental yields ~4.1% and vacancy ~0.5% indicate strong rental demand and low risk of extended vacancy. PRD Real Estate+1

- Units can deliver even higher yields in many cases (~5%+ quoted in some reports) which aligns with your note about “affordable units” being a good strategy. Herron Todd White

Product Mix & Timing Strategy

In Toowoomba, the market says “you can still buy affordable units / change your product mix” is a reality in this context :

- While houses have experienced strong growth (and often higher purchase price), house-&-land packages or units may offer better yield-to-price ratio and still capital growth potential.

- Given the growth path and infrastructure coming, being earlier to enter the market (or selecting product wisely) may deliver stronger outcomes.

- Recognising that even though some commentary suggests Toowoomba is “at peak” for some models, the data show the infrastructure and demand tailwinds haven’t fully played out, which means the upside for investors is still present and available.

What to Watch / Key Considerations

- While strong growth is evident, investors should consider location, quality of property, product type (units vs houses), and the suburb’s potential for growth. Selecting the ‘best fit’ property in Toowoomba is paramount to a successful investment.

- Infrastructure takes time to deliver, and just about always improves property prices in the region of development — for example the Inland Rail components are still in planning/approval stages, during construction will provide new jobs, as well as after construction, placing further demand on housing in the area. Inland Rail+1

- Market cycles apply: Entry price should be appropriate. Over-paying will reduce yield and cushion in tougher conditions and trying to squeeze the ‘wrong’ property into your budget will also not yield you financial benefits as ‘best fit’, investment grade property in Toowoomba would.

- Because the market is becoming more competitive, selecting the right product (location, quality build, dwelling type, floor plan being appropriate size and more …) is even more important.

In Summary

For investors seeking out locations worthy of their investment dollars, the South East Queensland regional market mitigates risk having sound market fundamentals — affordability, strong infrastructure pipeline, rental demand, and capital growth prospects — Toowoomba stands out. If you position the right product, focus on growth suburbs and maintain a long-term view, you can potentially capture both rental yield and capital growth. Encourage the reader to contact your business for tailored advice, suburb analysis, and program of how you identify “good ones”.

The outlook for the Toowoomba property market remains positive, with analysts forecasting continued price growth throughout the rest of 2025. The market is favorable for both investors (due to high demand and quick sales) and investors (due to strong yields and capital growth potential). Buyers are advised to act decisively due to competitive conditions and limited stock

Key Factors Driving the Market

- Undersupply: The number of new dwellings and land releases is not keeping pace with buyer demand, which continues to drive prices up.

- Population Growth: Toowoomba’s affordability relative to major cities like Brisbane, coupled with its strong local economy, job market, and lifestyle appeal, continues to attract new residents and internal migration.

- Infrastructure Projects: Major developments such as the Inland Rail project, Wellcamp Airport upgrades, and the city’s role in the 2032 Brisbane Olympics are enhancing its economic appeal and long-term value.

- Strong Rental Market: The extremely low vacancy rate (around 0.5%) and healthy rental yields make Toowoomba an attractive option for investors.

- Anticipated Interest Rate Cuts: Forecasted interest rate cuts are expected to further boost buyer activity and affordability in the market.

Where to Invest in Property in Queensland 2025

Australian Property Market Poised for Growth

Queensland Demand Surging and Supply not Keeping up, what it means for investors?

Other SEQ Investment Locations worthy of your Consideration